1 / 11

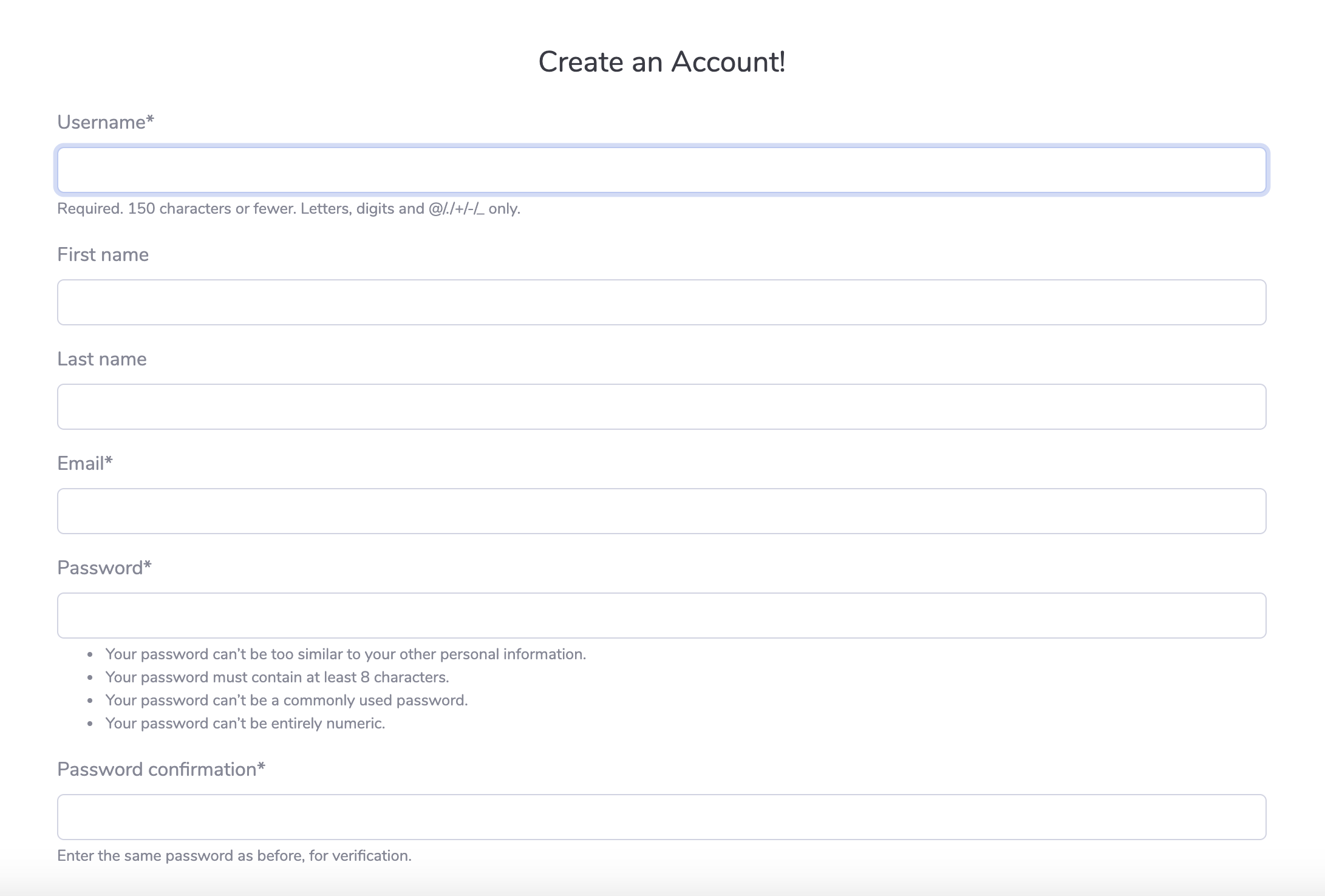

1. Login

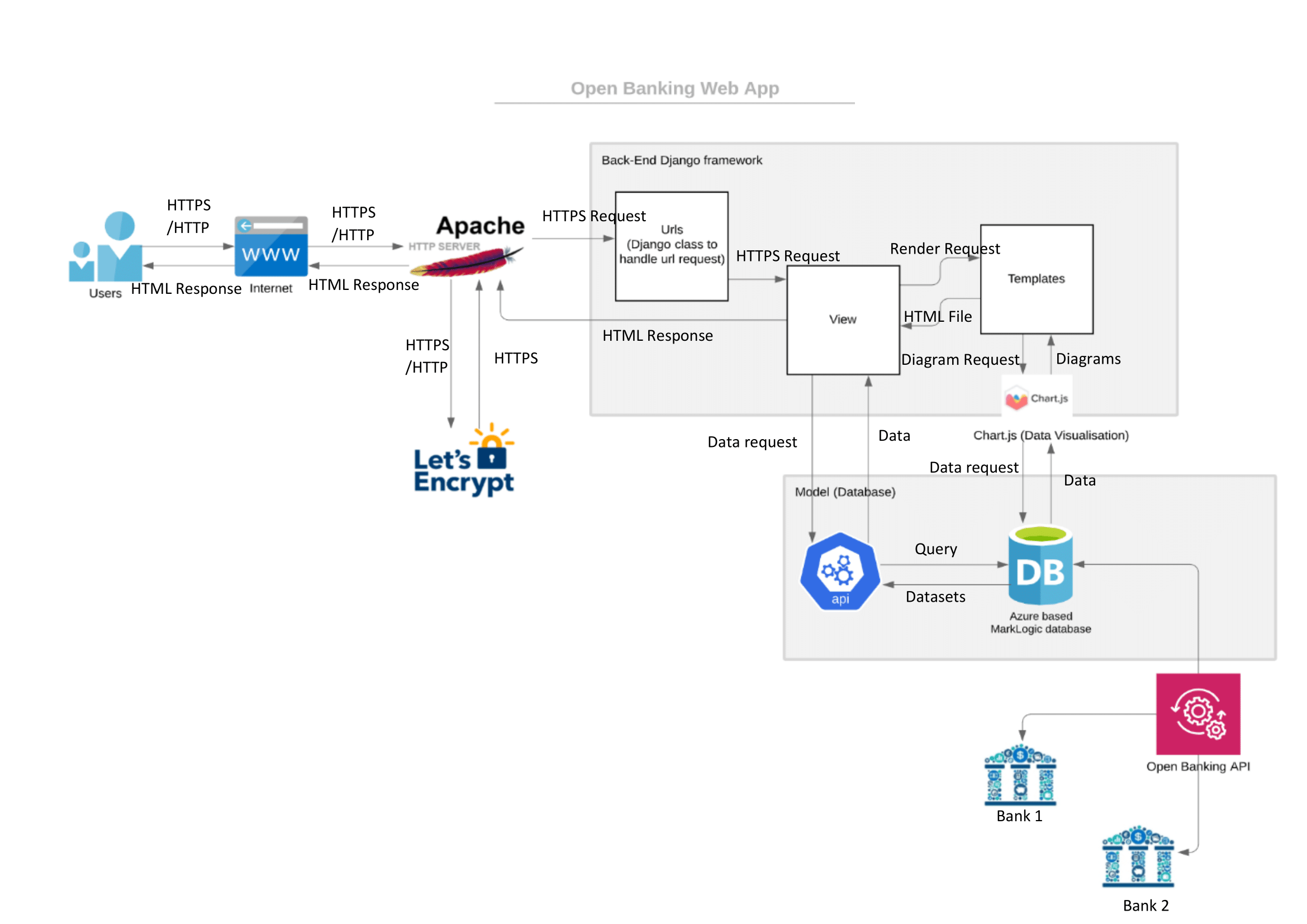

System

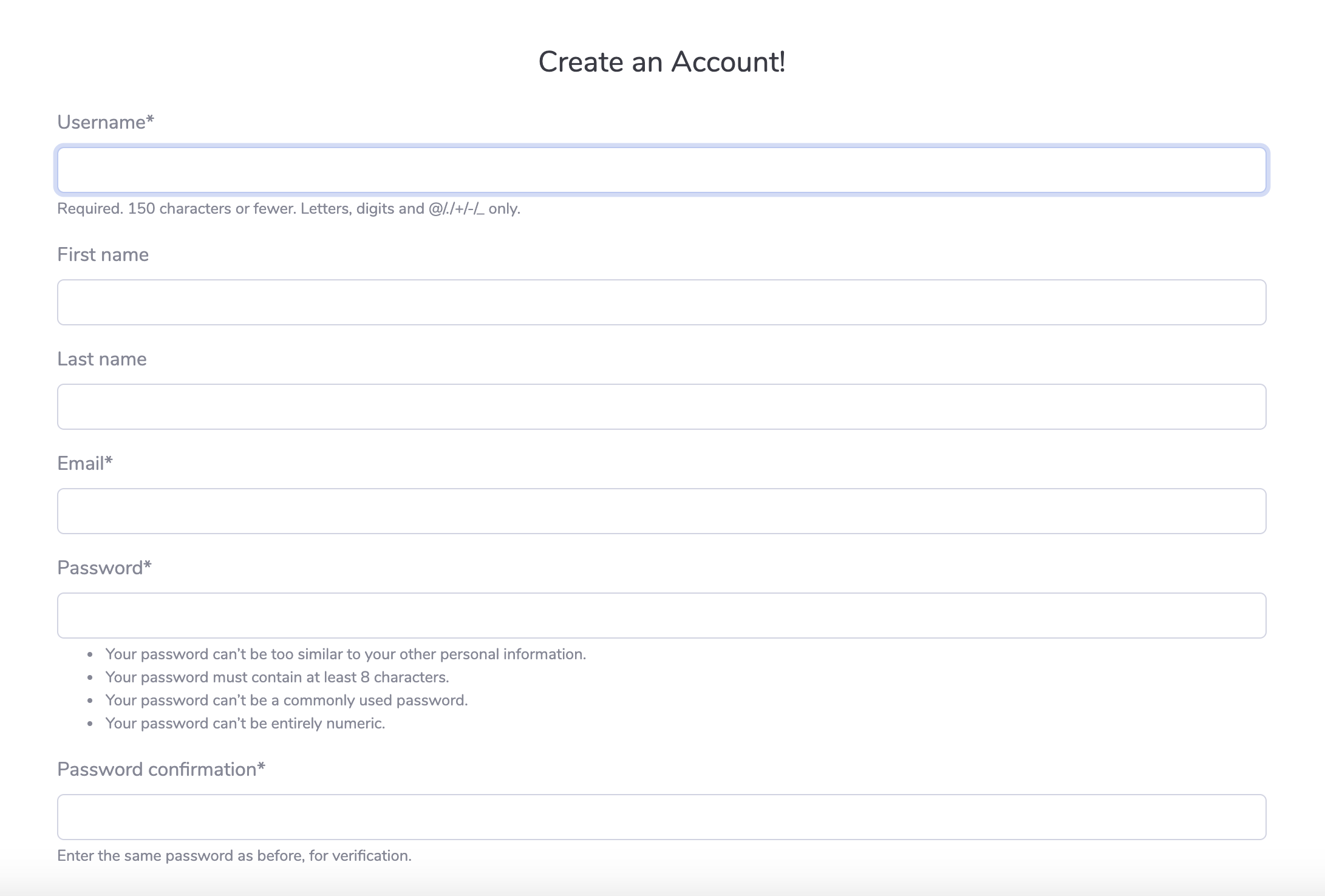

Our web app needs users to link their bank accounts to their accounts in our

app. We

have

implemented password strength requirements when users sign up and session

cookies

that auto

logout

users inactive for 10 minutes. These are part of our security measures to

protect

user's

sensitive financial information.

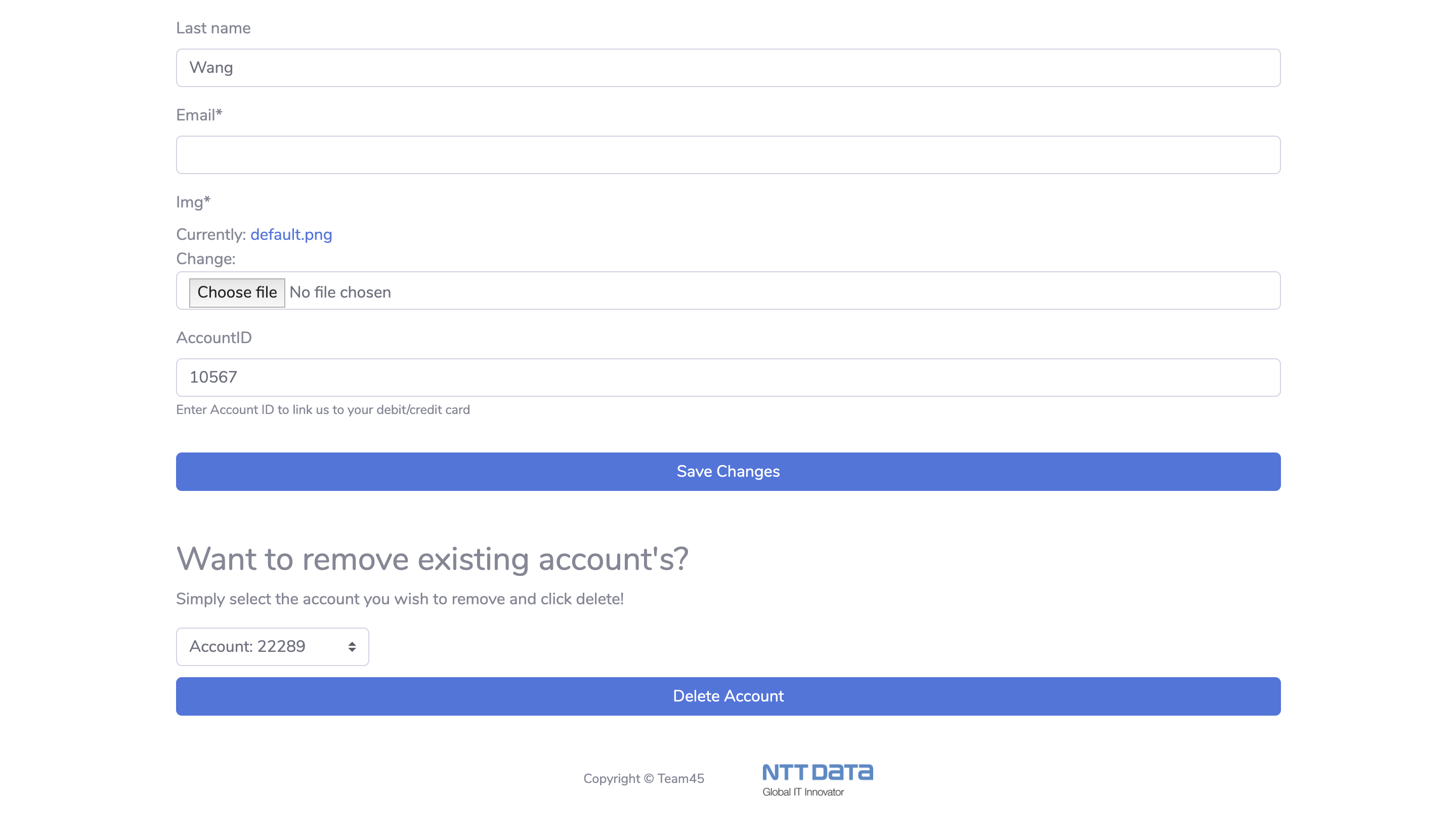

2 / 11

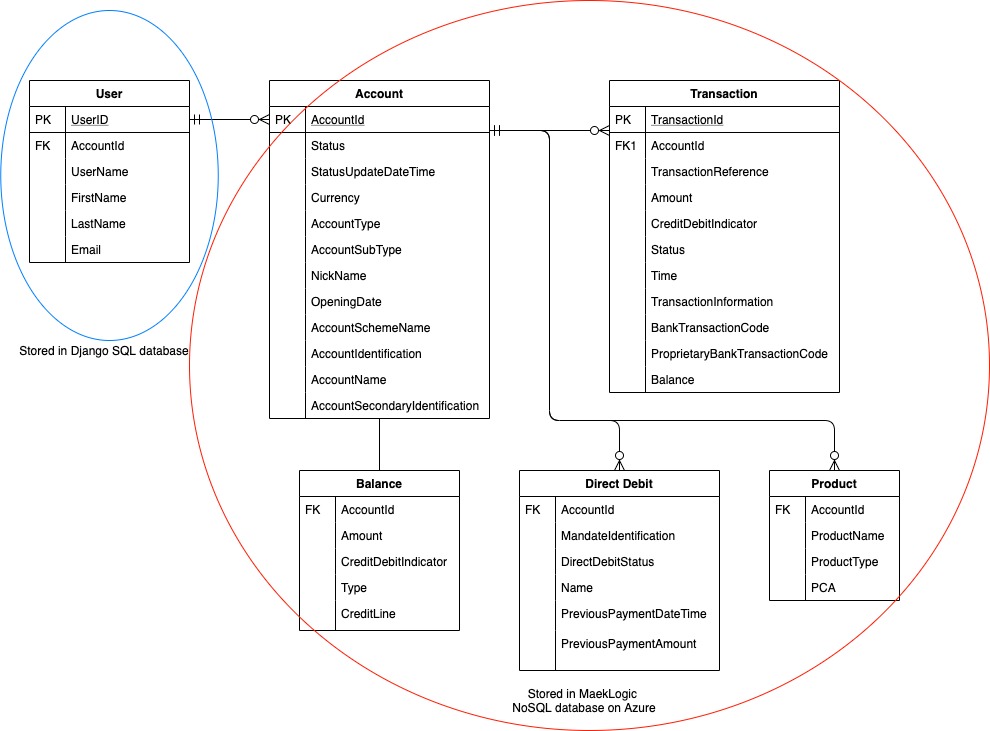

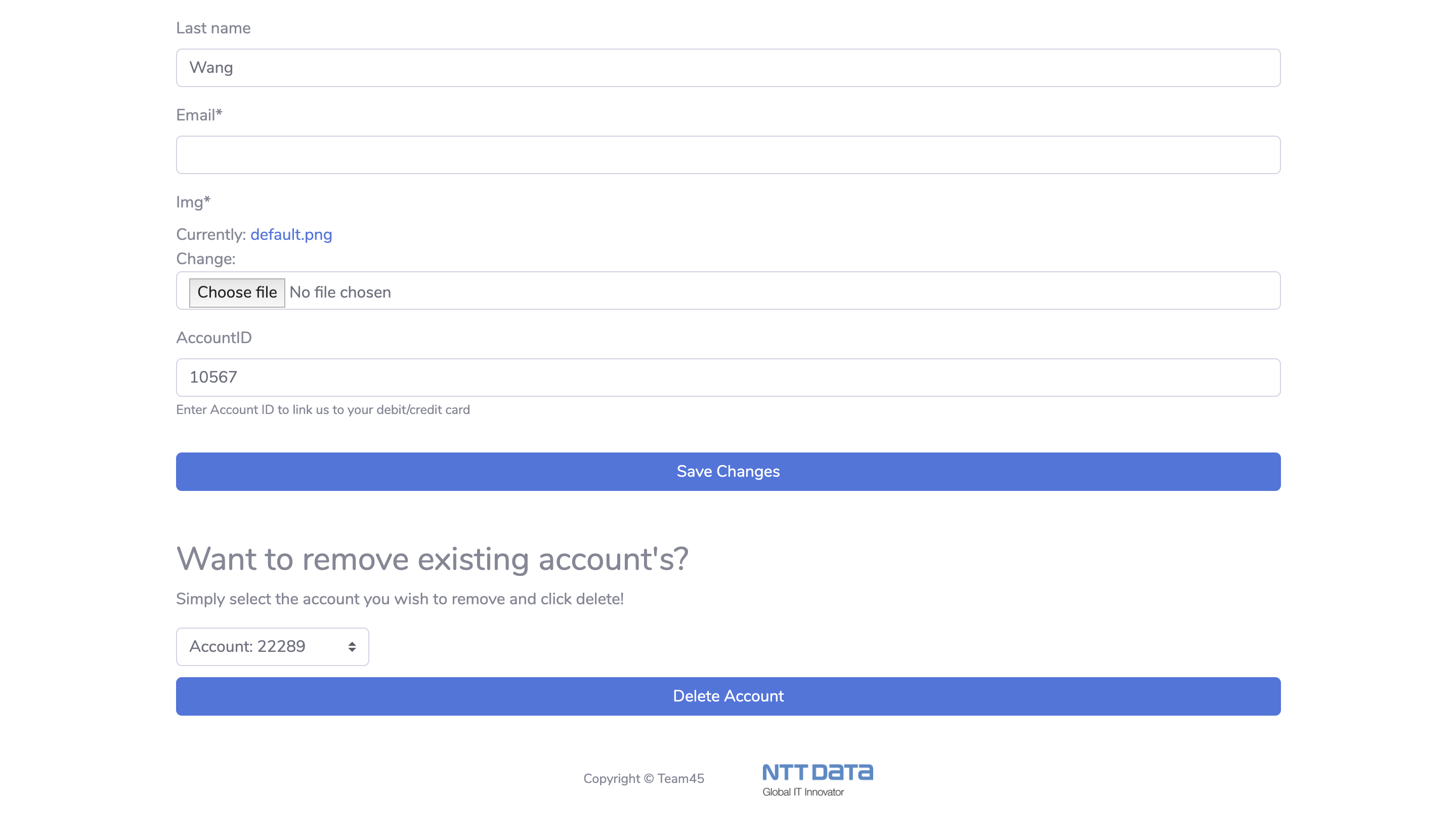

2. The

current webapp allows users to add

multiple accounts. (Current and Credit Card)

Being the key idea of Open Banking, we consolidate financial information

from

various

financial

institutions and present them together for the user, we implemented this

feature

to

allow

users to add accounts that they want to track and remove accounts that

they do

not

care

about.

Different account types, such as current accounts and credit cards can

be

tracked.

3 / 11

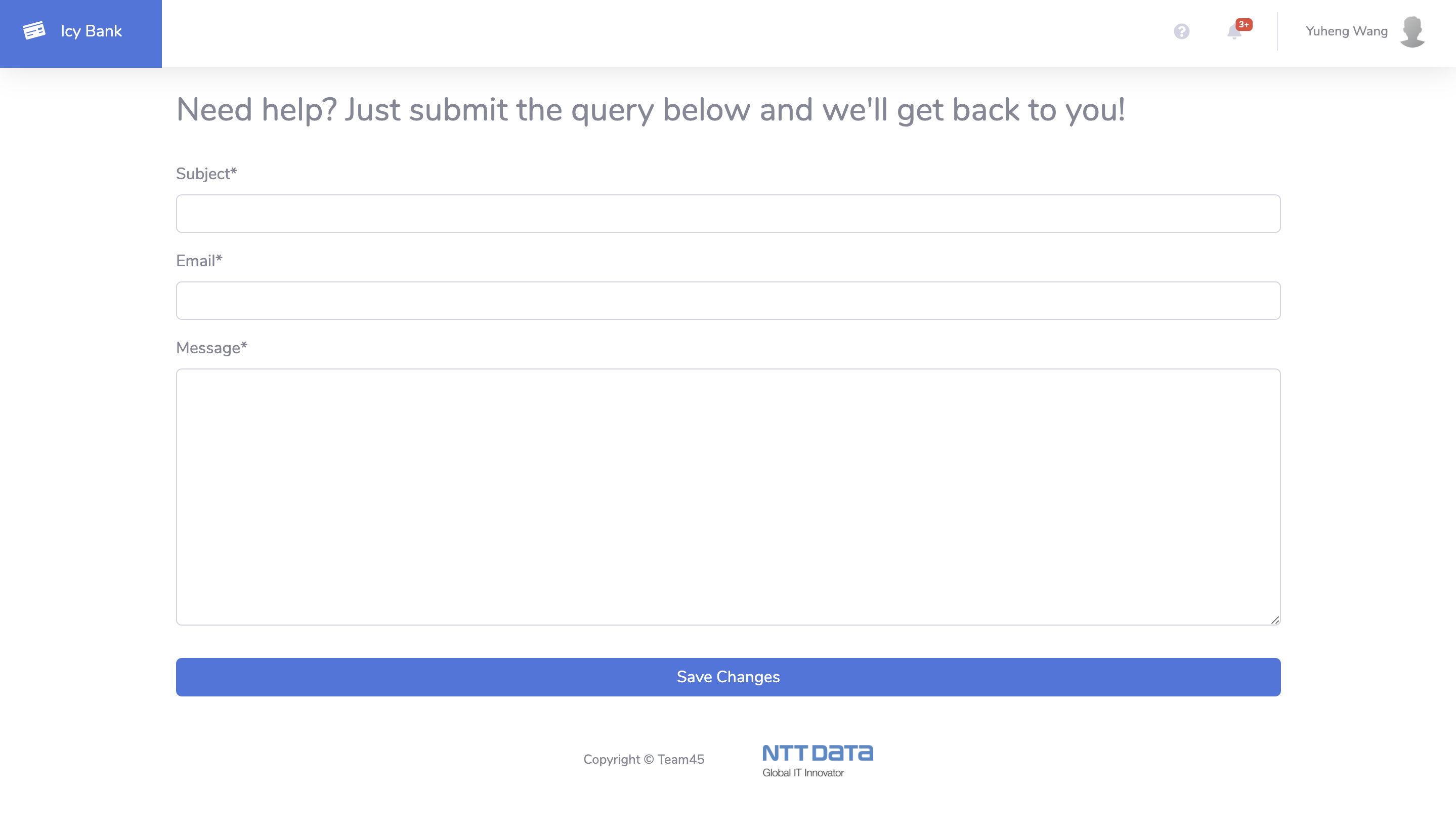

3. Help

system providing user feedback

and queries

We implemented a help page which allows users to submit feedback and

questions

regarding the

web app. The query will be saved in the admin page in Django framework

and be

sent

to our

admin email.

4 / 11

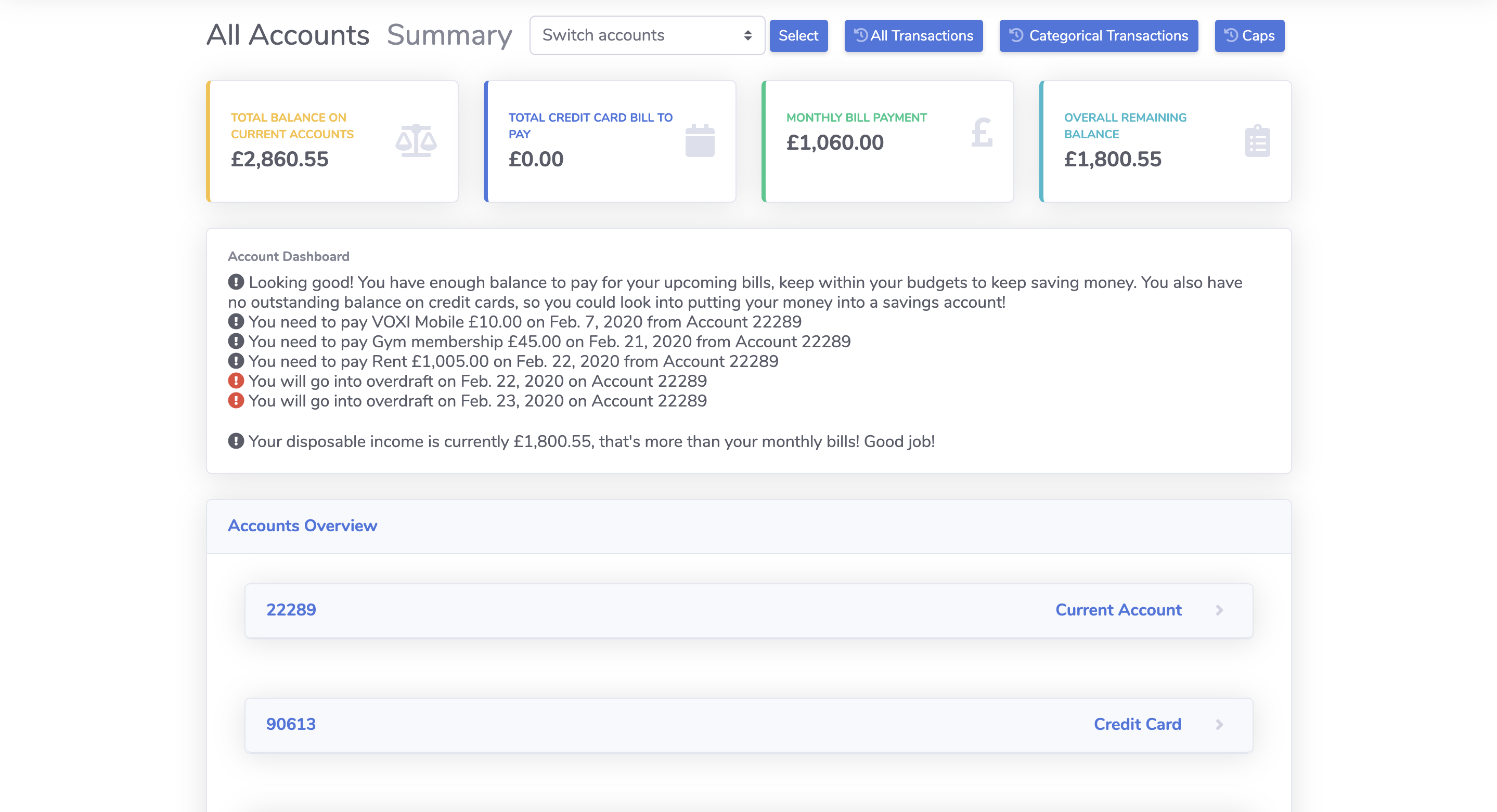

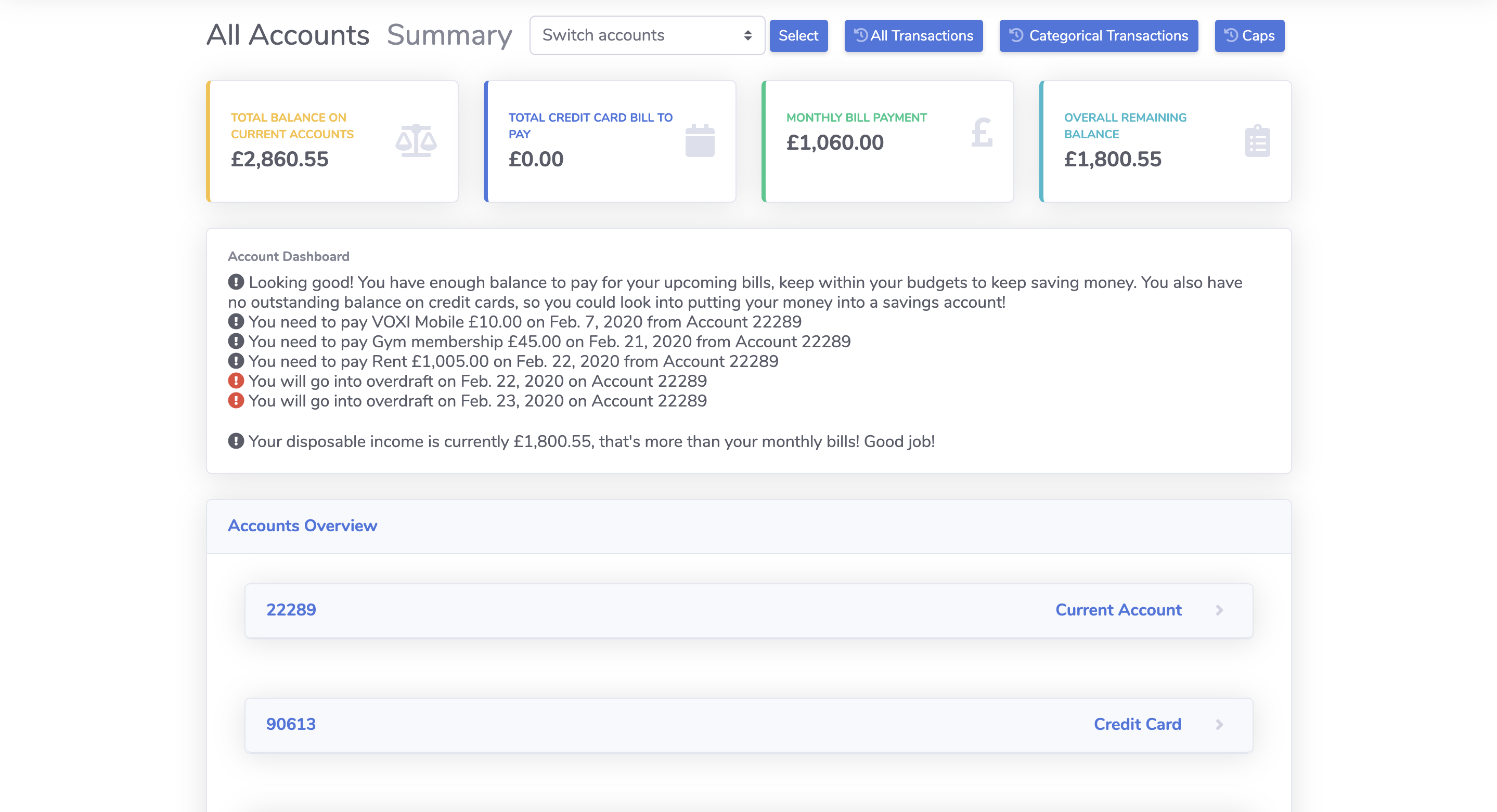

4. Users

have a centralised view on their

finance

Since multiple accounts are connected, our web app have a summary page

that

compiles

financial

data from all accounts and shows the important financial tips, bill

reminders

and

overdraft

warnings. This allows the user to see a full financial overview on

various

accounts.

Meanwhile,

we also have summary pages for current accounts and credit cards

separately as

they

show

different insights into different types of accounts. Users thus could

understand

their

financial

data better.

5 / 11

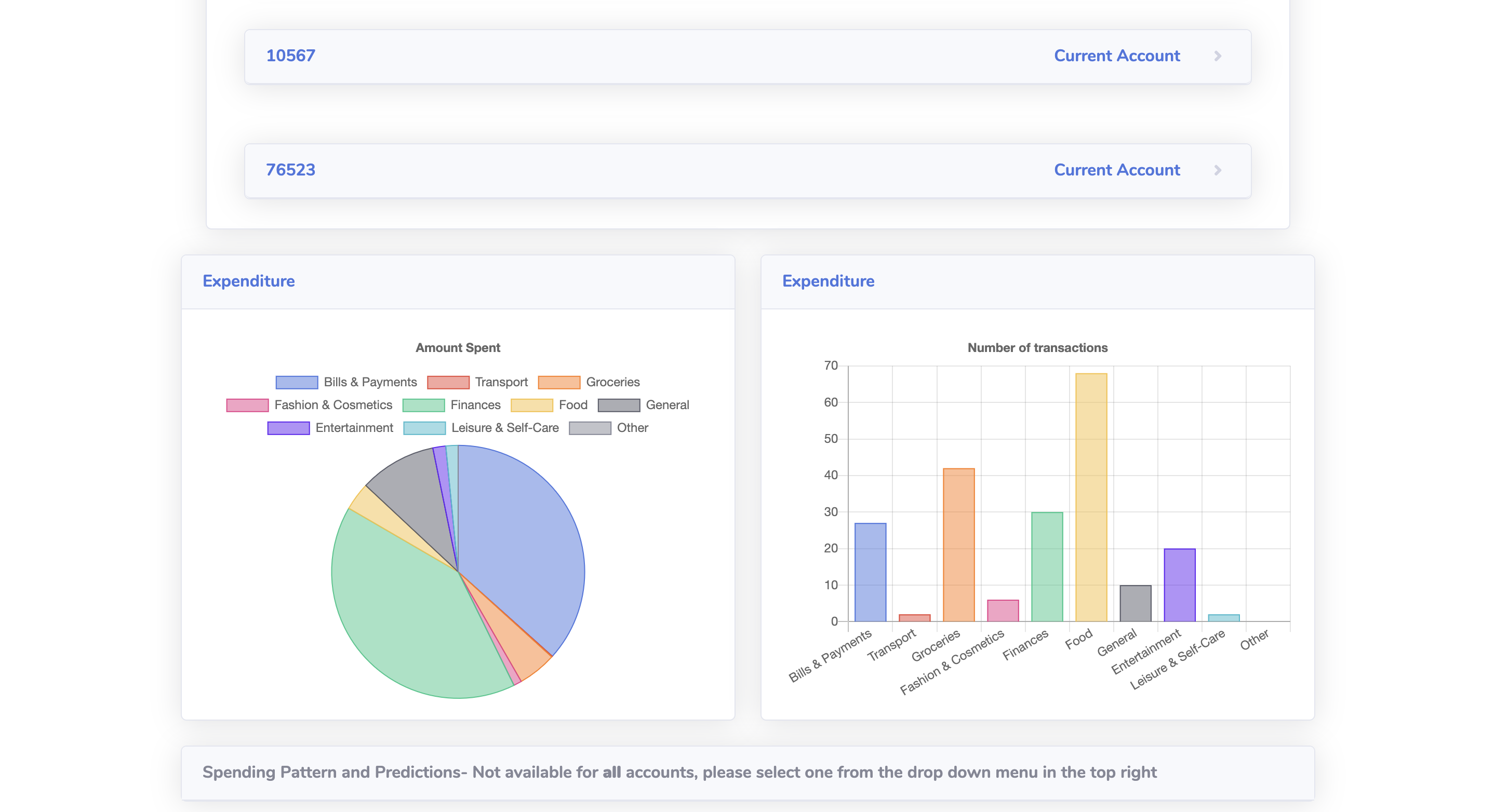

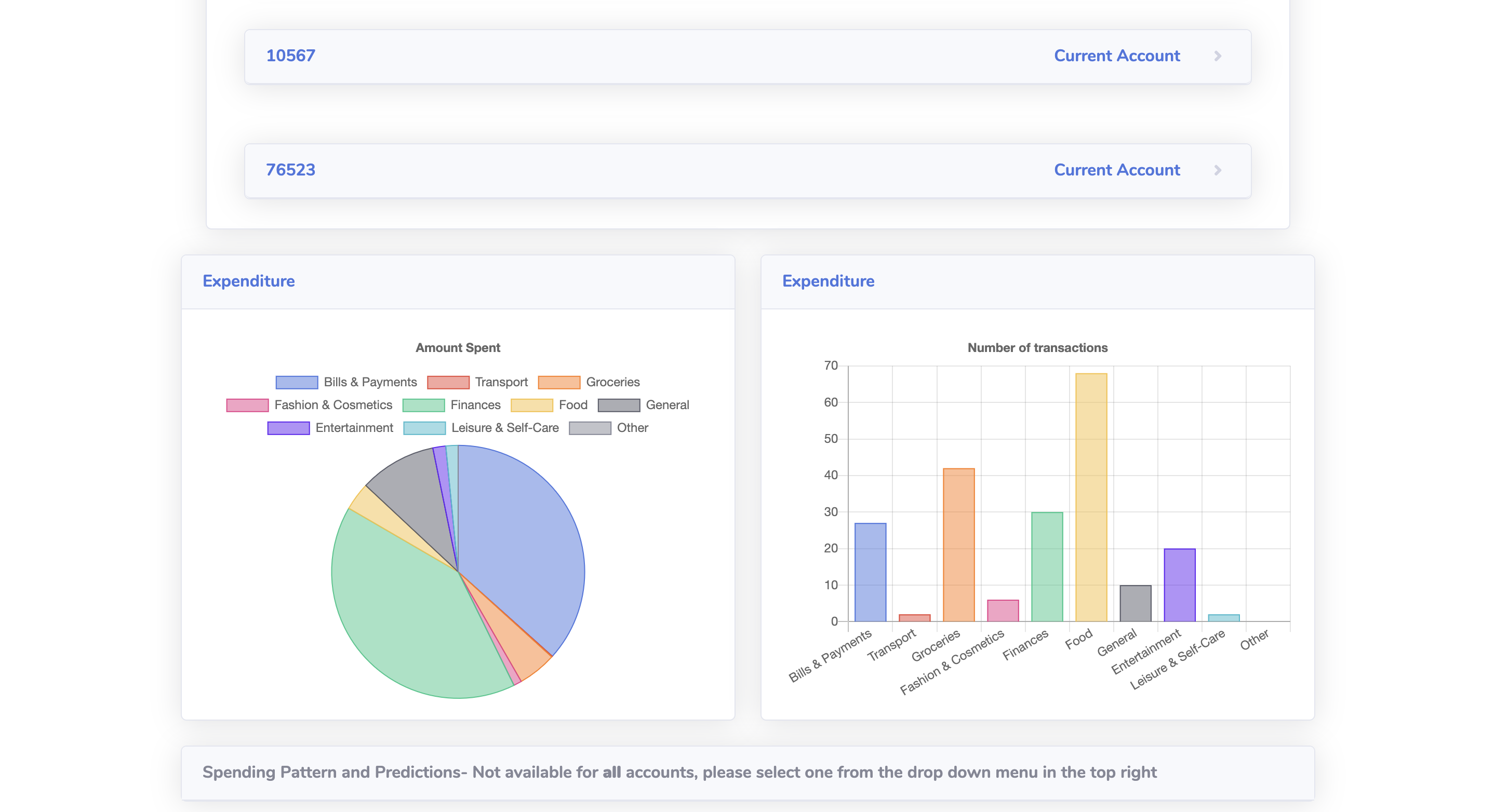

5. Financial data

is

categorised

Financial transactions are categorised under 'Bills & Payments',

'Transport',

'Groceries',

'Fashion & Cosmetics', 'Finances', 'Food', 'General', 'Entertainment',

'Leisure

&

Self-Care'

and 'Other'. This provides the user with a deeper understanding

regarding their

financial

expenditure.

To categorise financial data, we used Merchant Category Code that comes

with

every

piece

of transaction data provided by Open Banking api. It allows extra

accuracy in

categorisation

compared to the machine learning model we have built.

6 / 11

6. Bill

reminders

Bill reminders are catered towards each account. it analyses the

information

about

all

direct debits on an account and display active direct debits with next

payment

happening

anytime from now to the next statement day. Bill reminders remind users

of the

date

and

amount they have to pay the bills so they could decide if they want to

save some

money

for these bills.

7 / 11

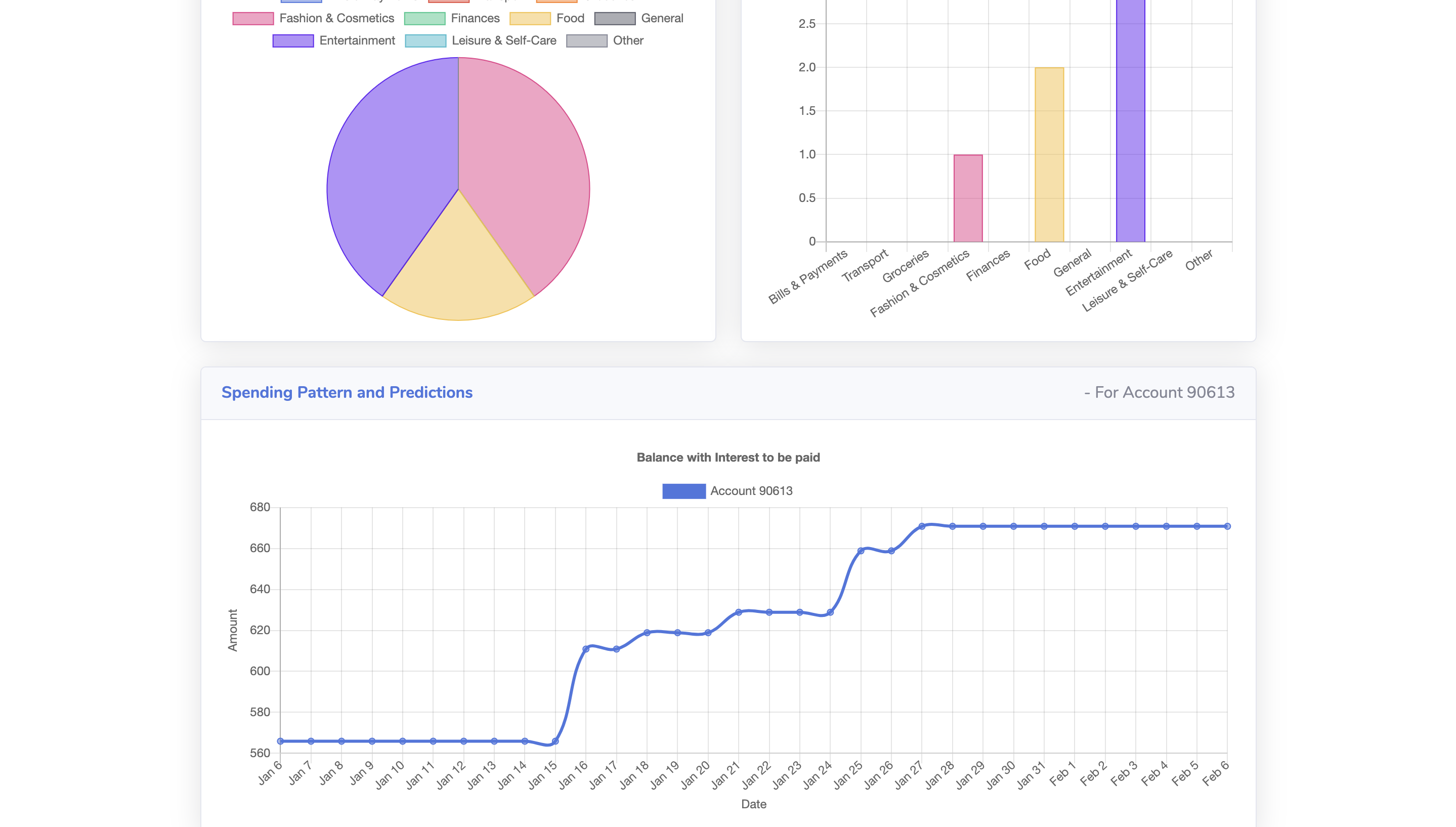

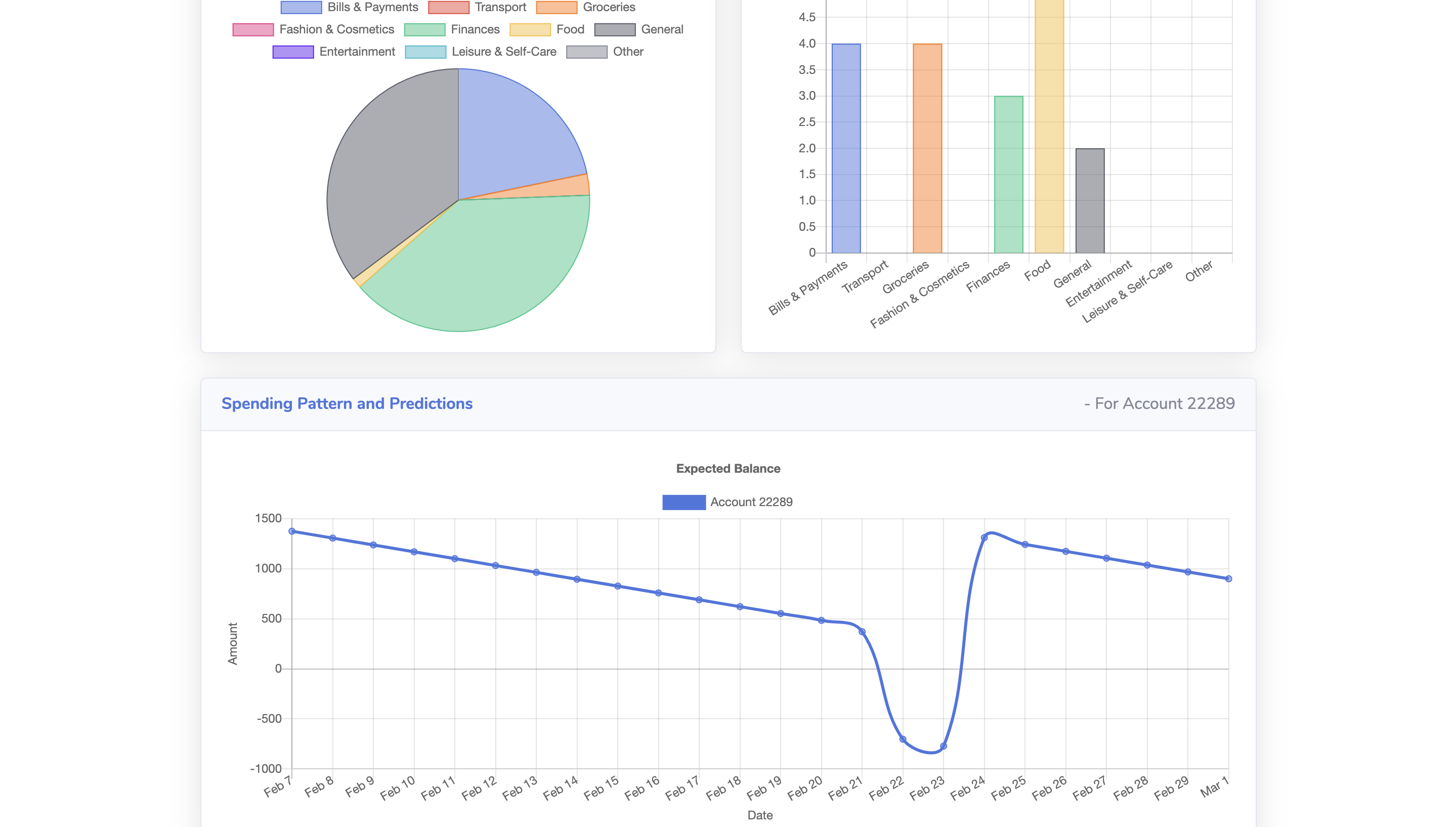

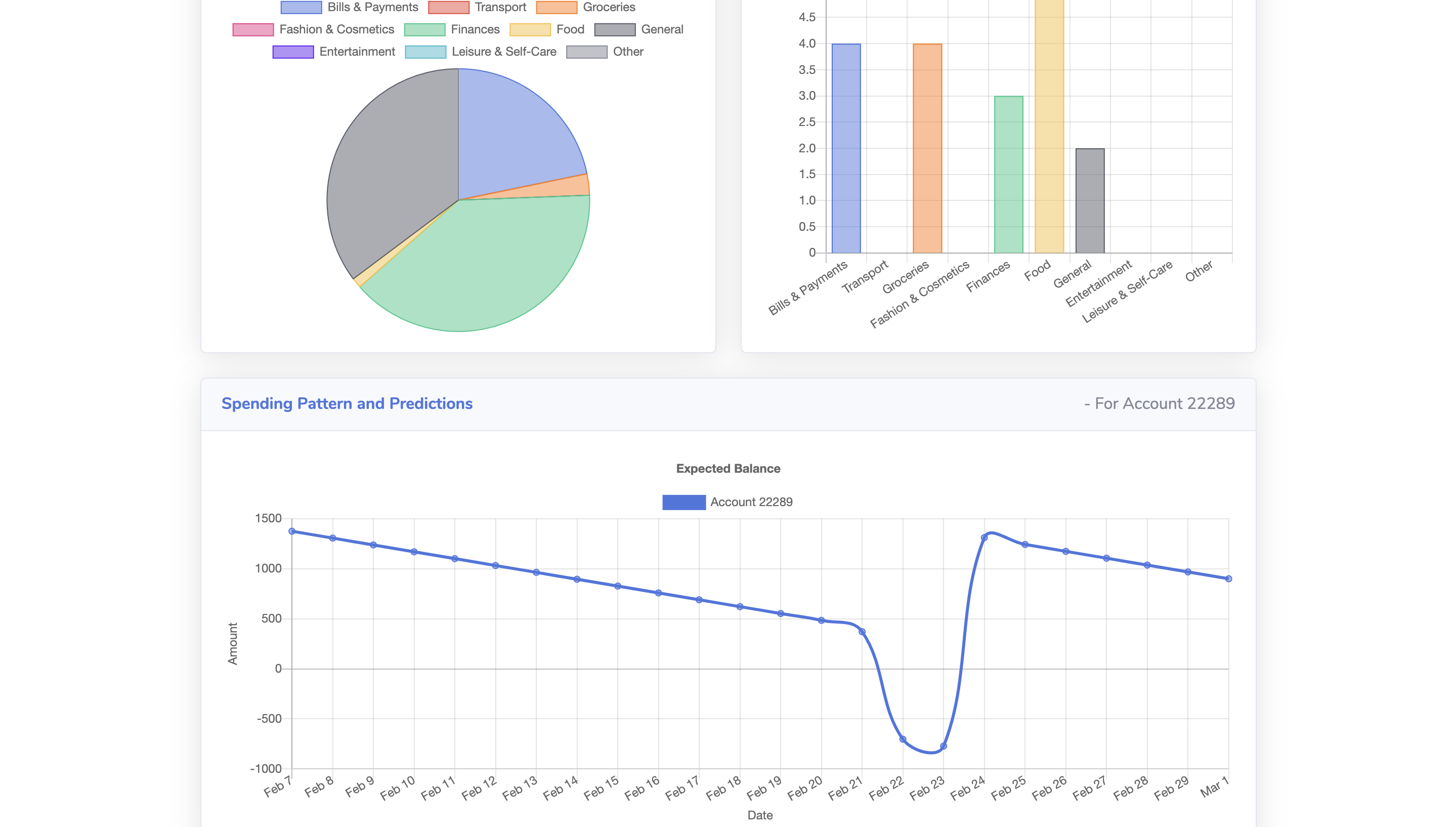

7. Dynamic data

visualisation using

Chart.js

Our visualisations are made using Chart.js. After processing and

cleaning the

data

in our

Django model, it is then used in our charts. According to the account

selected,

the

visualisations will reflect the respective account. Using customised

tooltips, I

have

successfully formatted the tooltips to display the correct number format

as well

as

currency

(e.g categorical amount spent pie chart), as well as adding lines to the

predictions

graph

if there were multiple accounts selected.

8 / 11

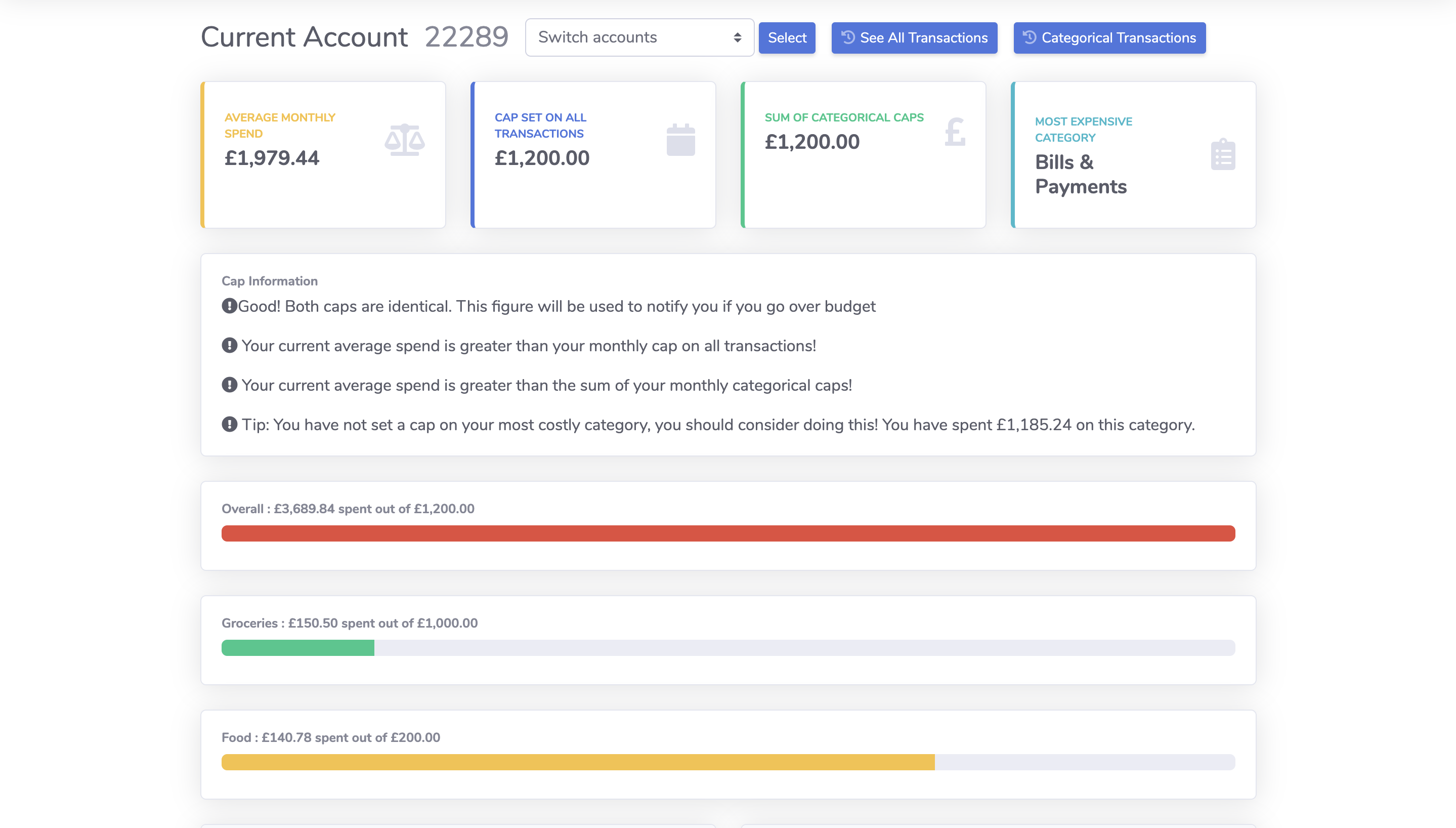

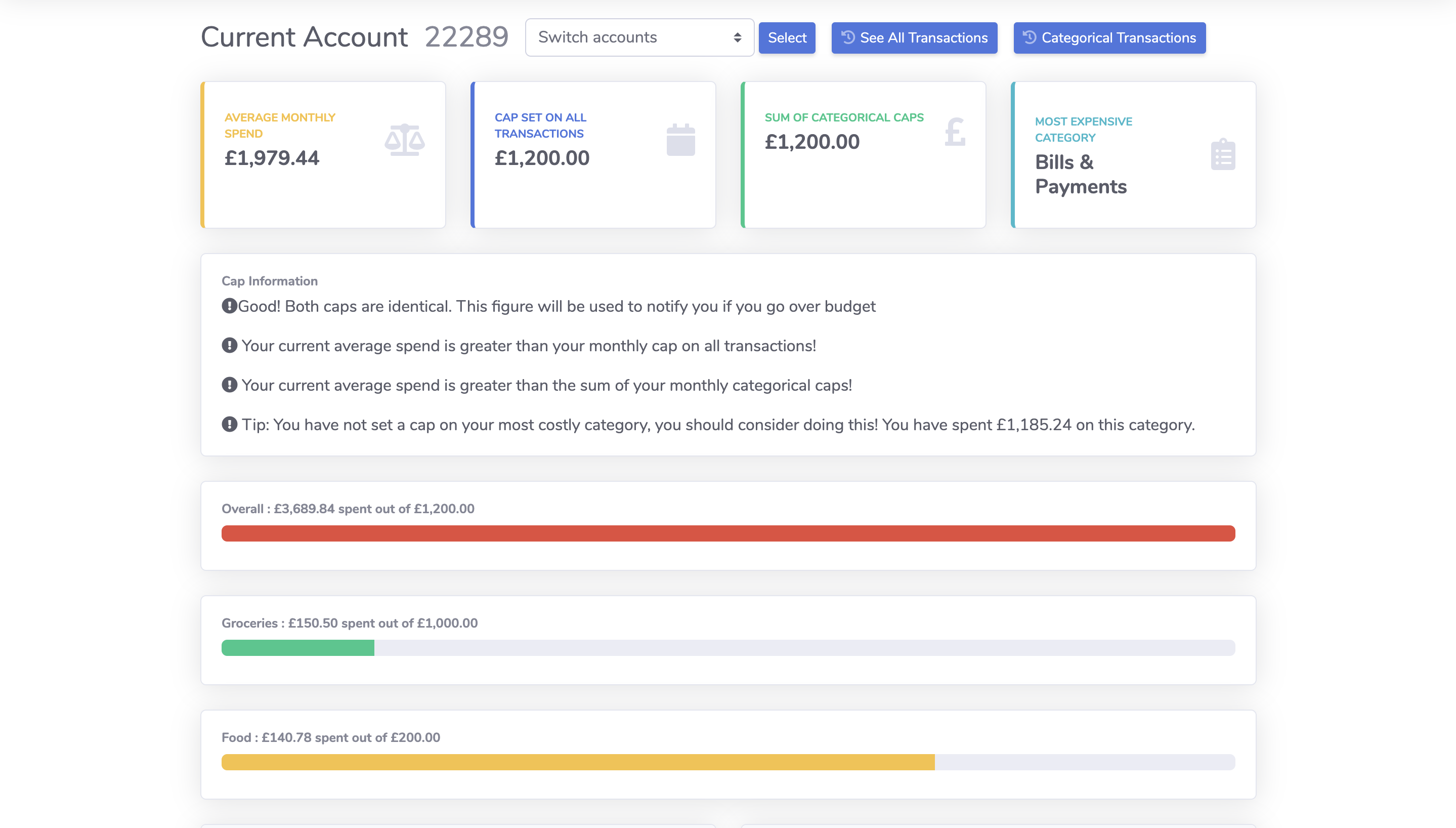

8. Budgeting

Caps

Using our budgeting caps, we can display whether the user is managing

his/her

finances

wisely. We have a caps page which has a list of budgets set for each

category as

well as how

much is spent for each category, if the spending is more than two third

of the

budget, the

bar

will turn yellow, notifying the user that he/she should spend more

wisely,

whilst

exceeding

budget would turn the bar red, therefore signalling that the user has

spent more

than

his/her

set budget. We believe this feature would assist the user in their

financial

management.

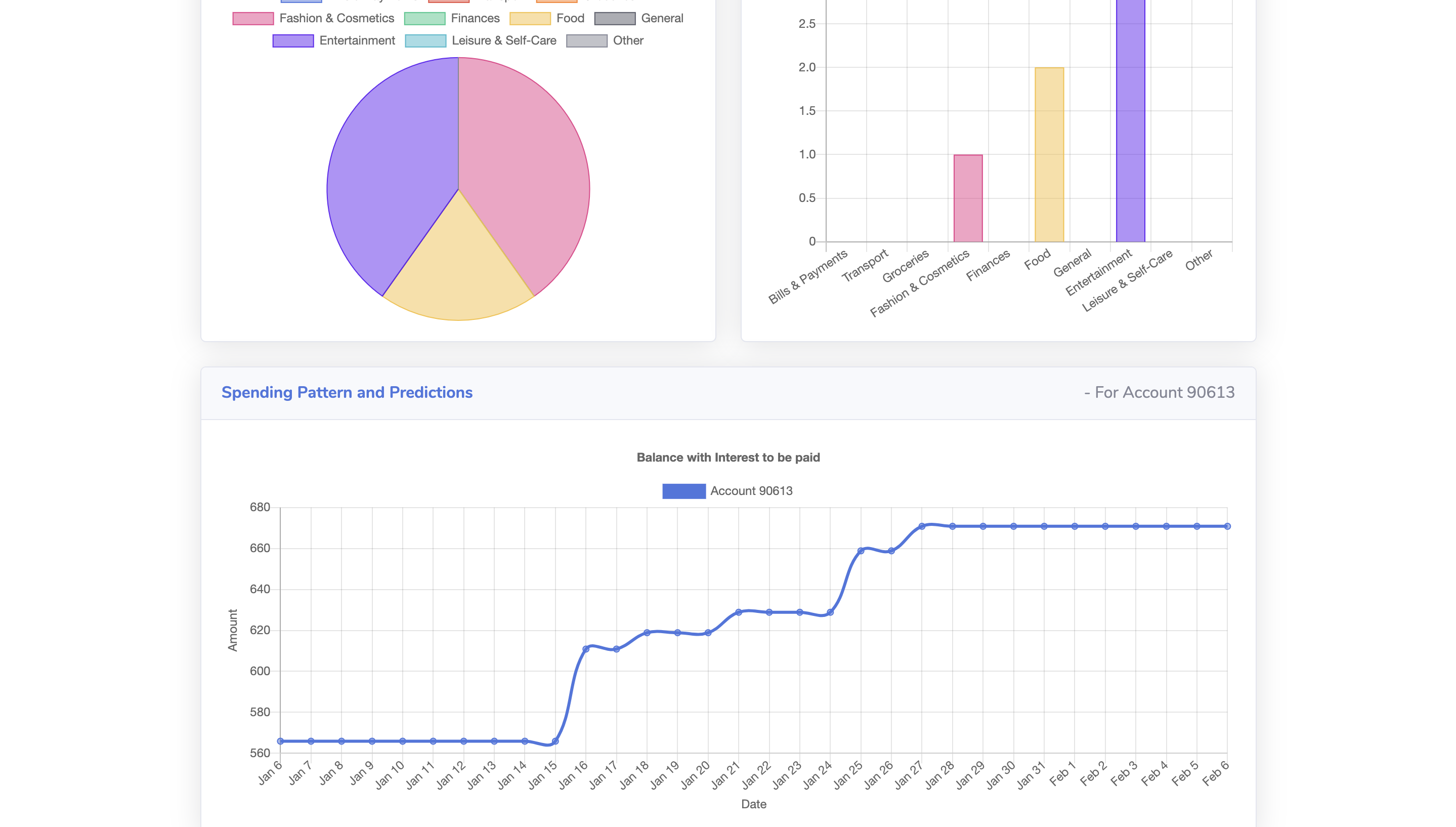

9 / 11

9. Data

predictions

On our categorical and full transactions page, we have a line graph

indicating

the

predicted

balance for the user. If the accounts selected are current accounts, it

would

show

the

expected balance for each day up to and including the next billing date.

Since

spending on

current accounts is more predictable, we assume users have a similar

daily

spending

as last

month and take direct debits and salary into account to produce this

prediction.

If

the

accounts

selected are credit-card accounts, it would display the past spending

trend as

spending on

credit card is more random. Instead, we will calculate the amount users

need to

pay

on their

credit cards so they do not need to pay the interest fees.

10 / 11

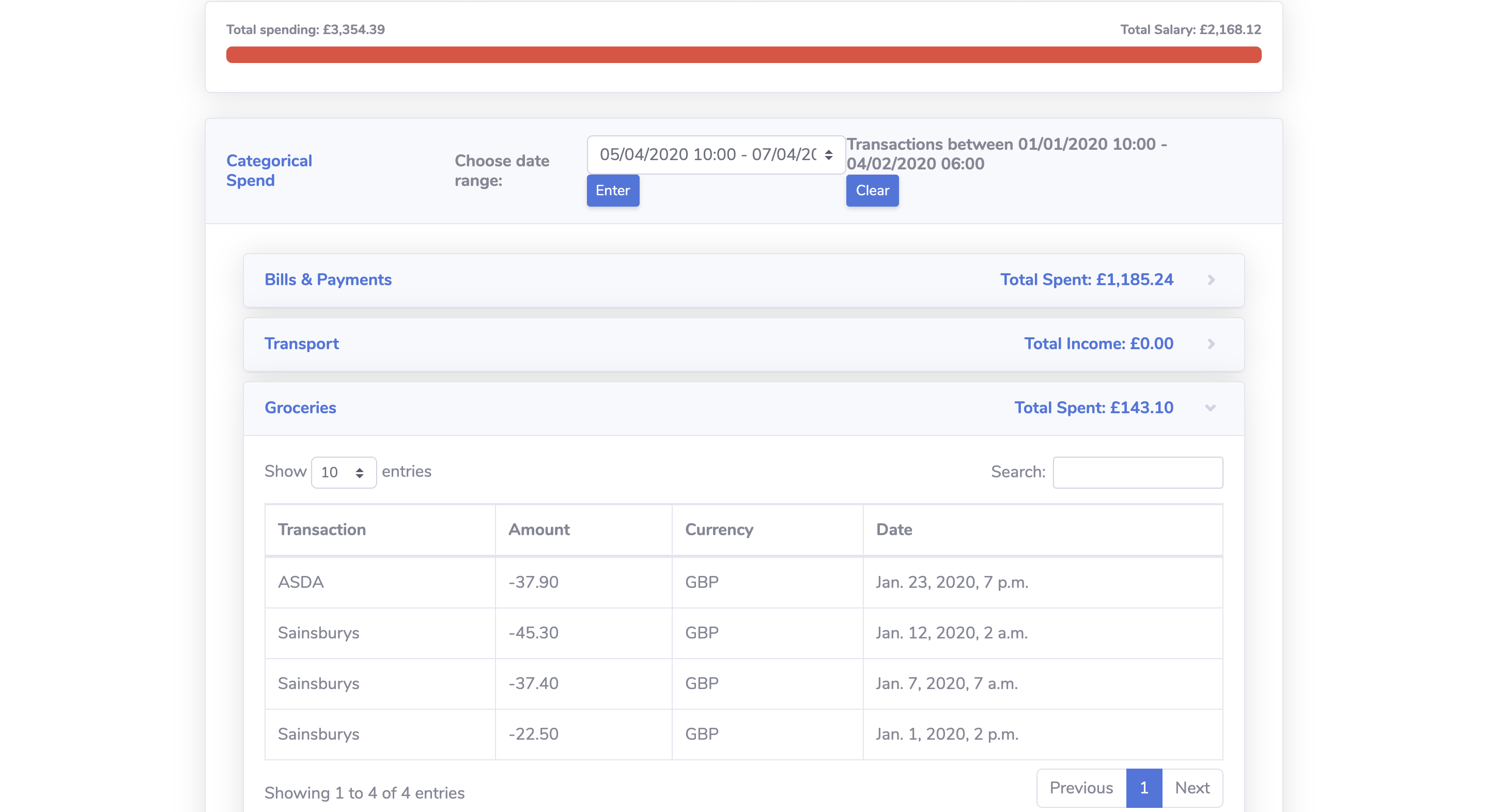

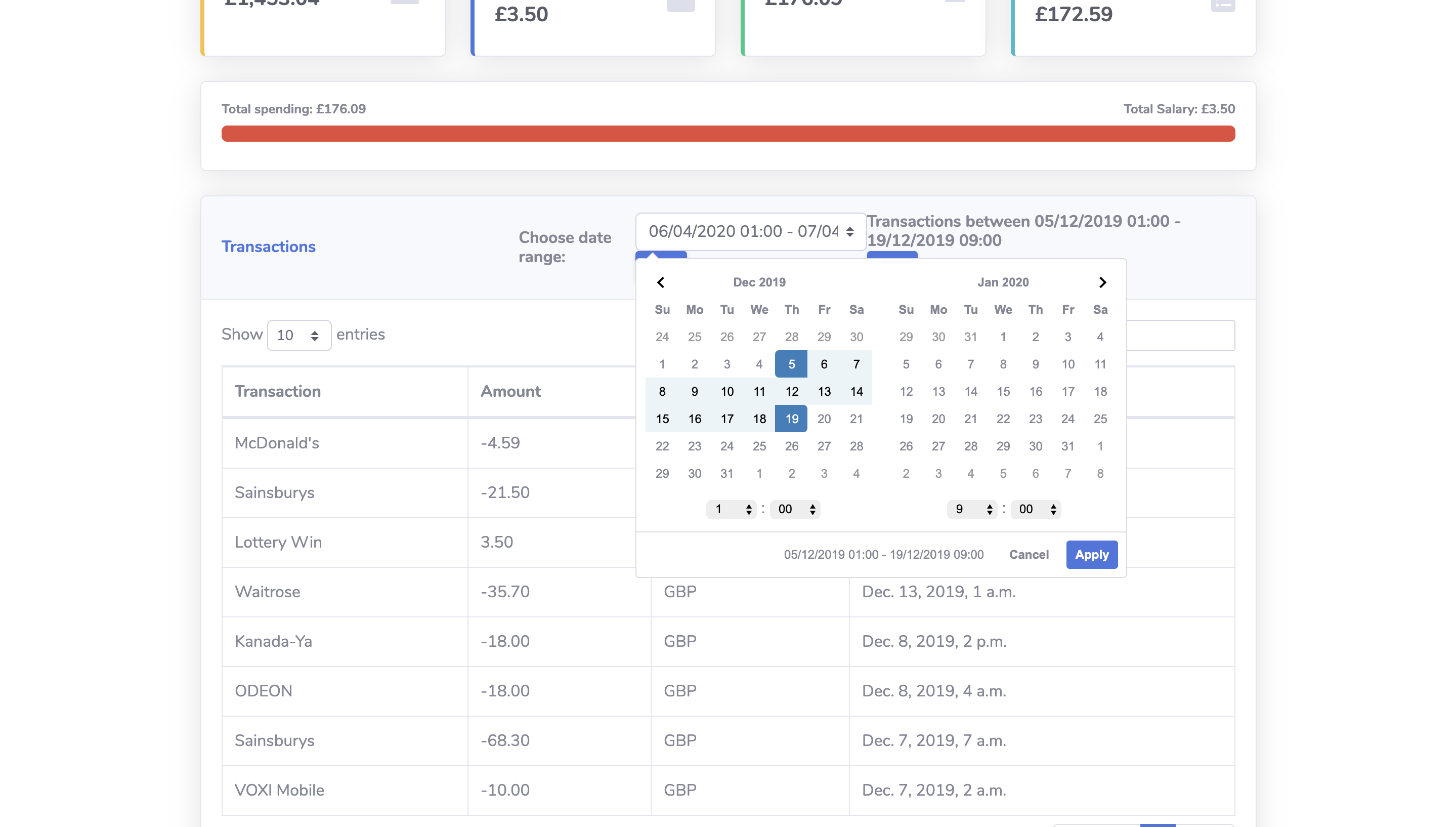

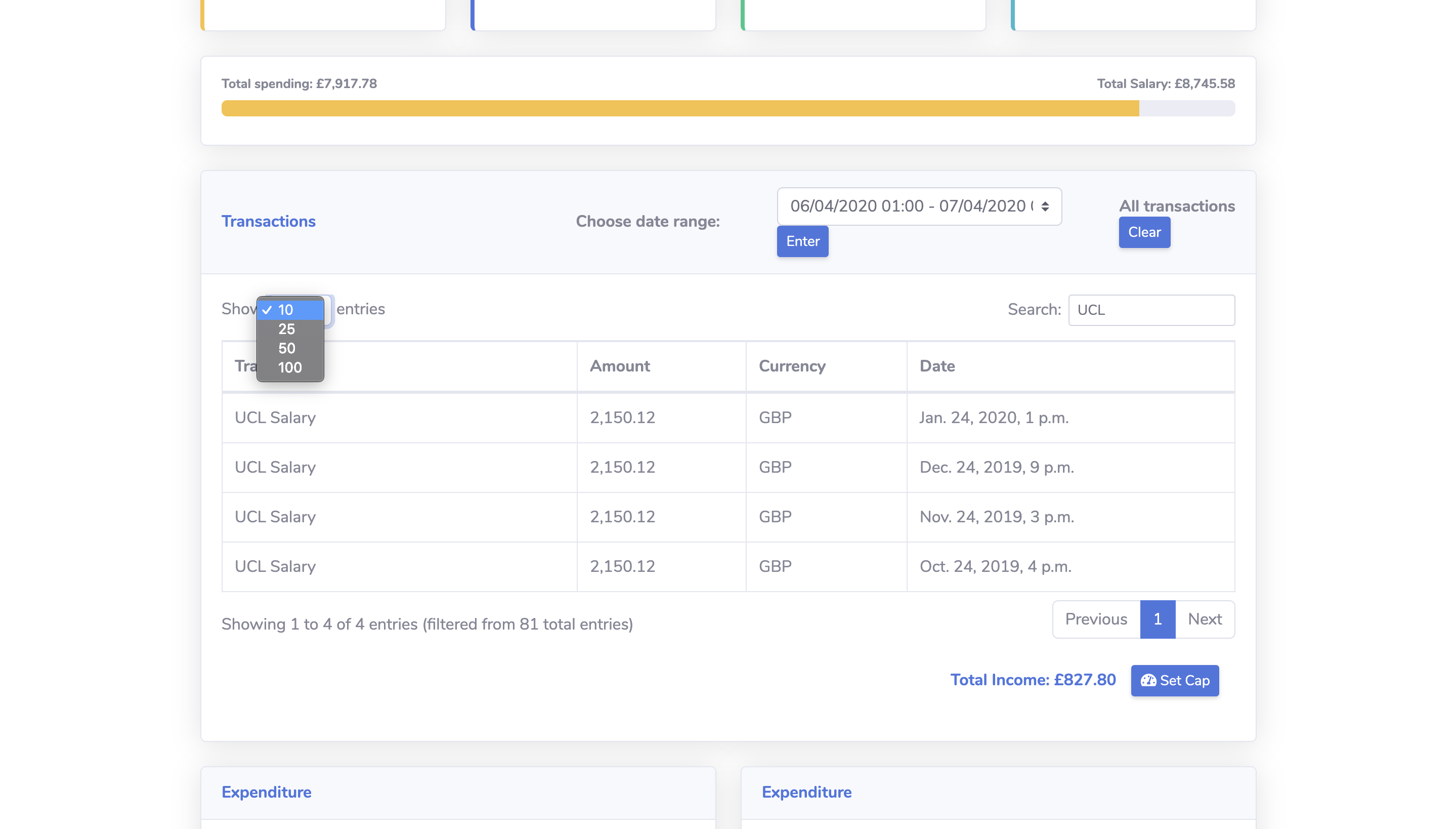

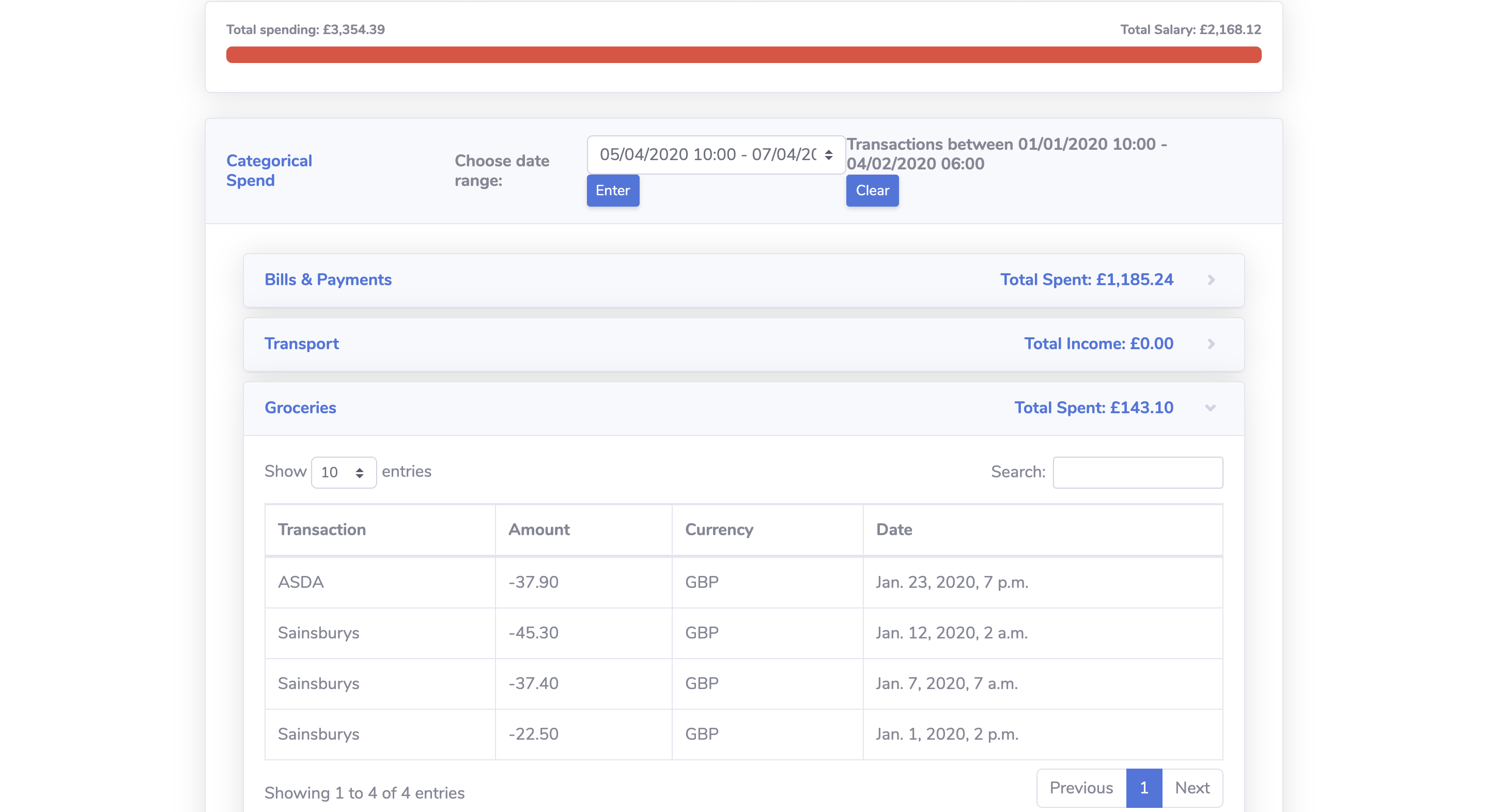

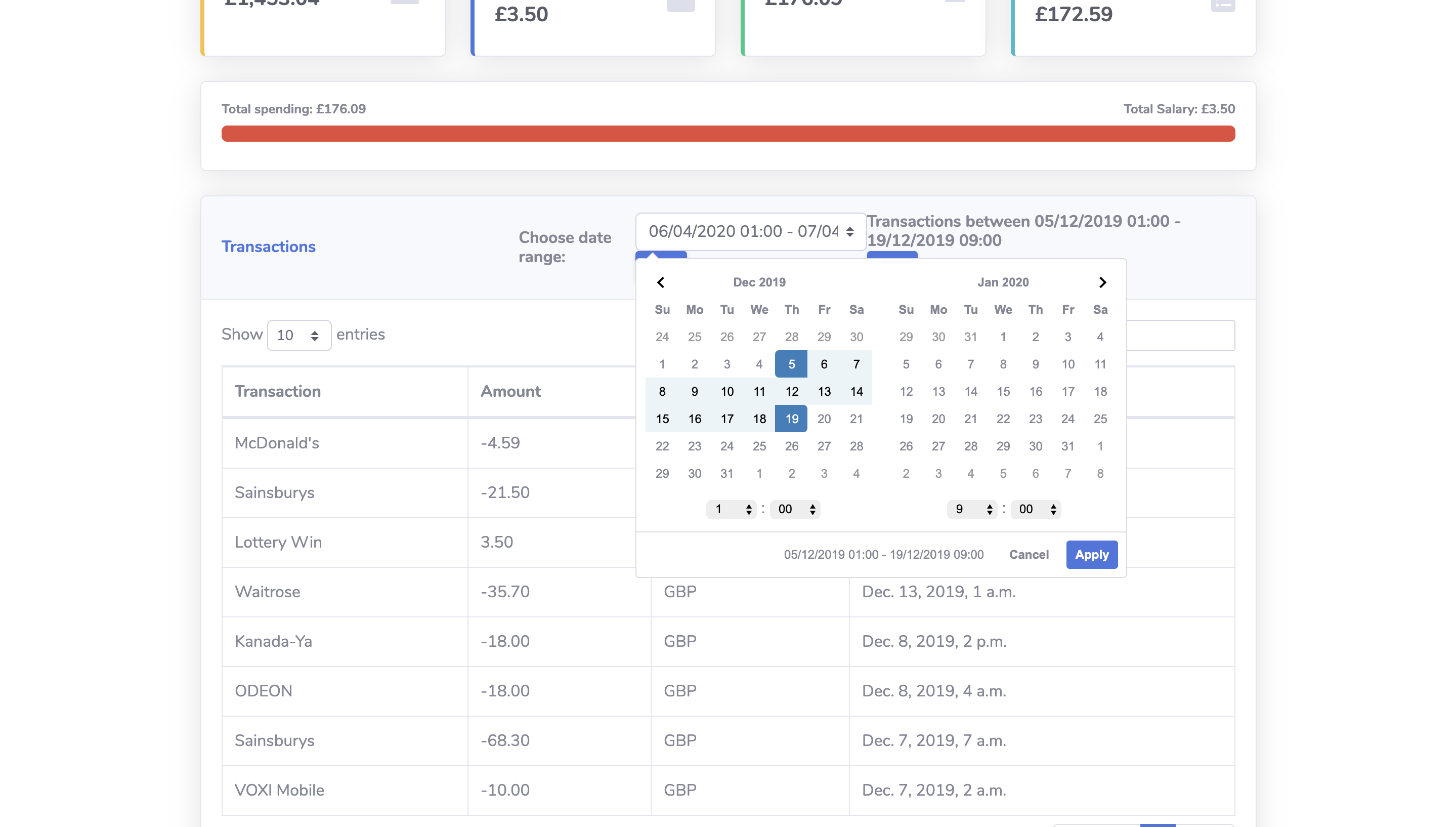

10. View

transactions in a certain date

range

We have implemented a date selection tool using daterangepicker.js. This

allows

the

user to

specify a time range in which they would like to view their

transactions.

11 / 11

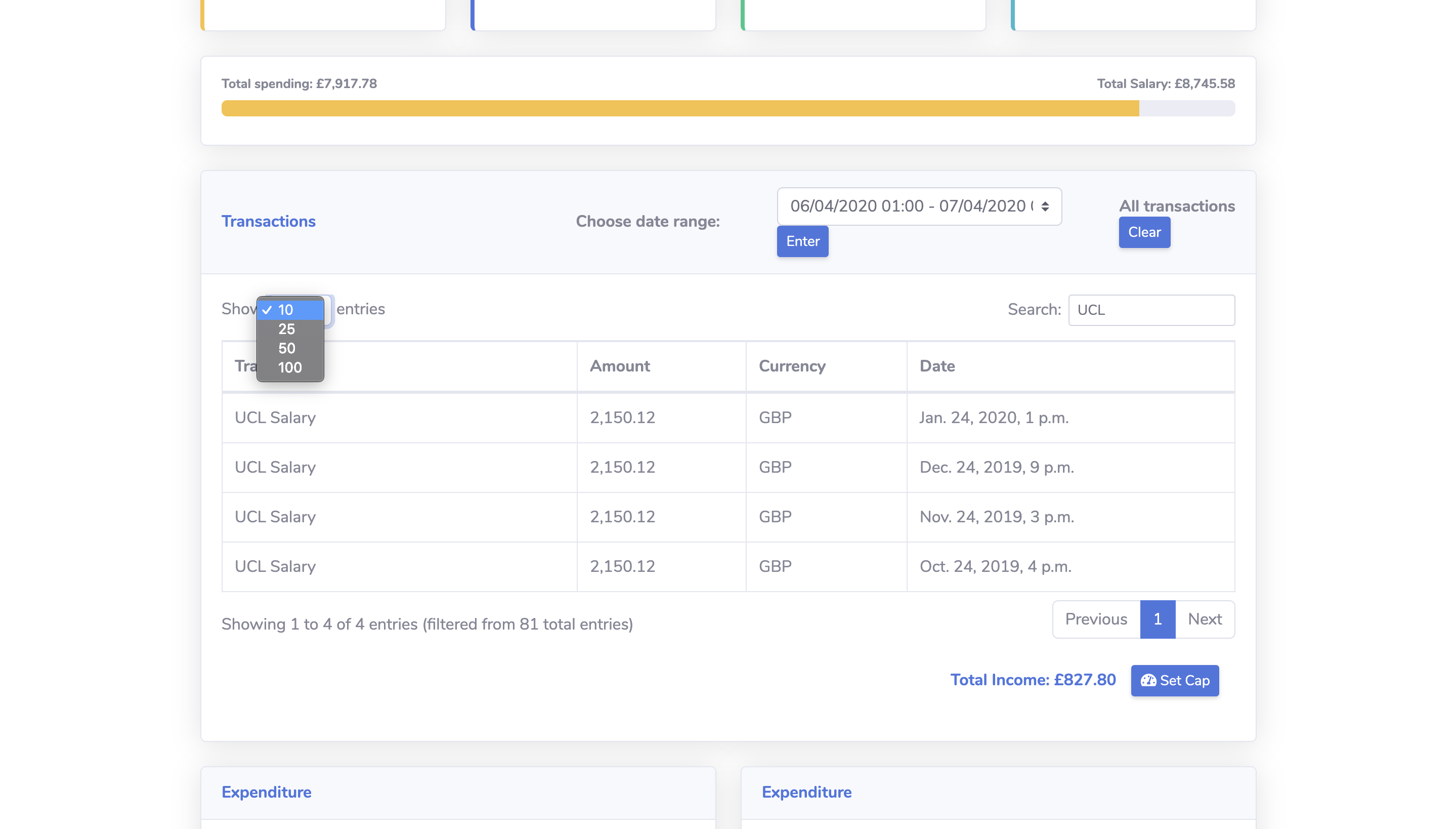

11. Pagination and

search

for

tables

Using DataTable.js, we implemented pagination and search for the tables.

Due to

our

large

set of data, it would make our web app page very long and ugly,

therefore,

implementing

pagination allows the user to go through multiple pages of the table,

reducing

the

clutter

on the web page. It also allows the user to specify the number of

transactions

per

table

page. Using the search function also narrows down the financial

transactions,

this

in turn

allows the user to view transactional data for a particular shop per se.

❮

❯